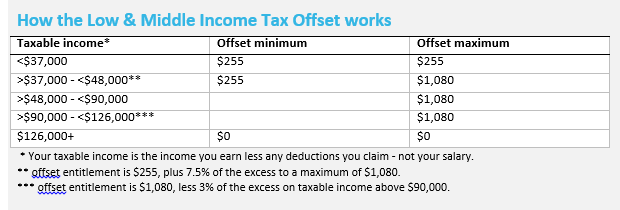

A low and middle income tax offset (LMITO), first introduced in the 2018-19 Federal Budget, provides a tax benefit to those with taxable incomes below $125,333. Recent changes increase the LMITO from a maximum of $530 to $1,080 and the base amount from $200 to $255, and make it applicable to a greater number of taxpayers by increasing the threshold from $125,333 to $126,000.

The first thing to remember is that this is a tax offset; you need to owe tax to offset the tax.

And, if you owe tax, the offset will be first used to reduce the tax you owe. It is not a cash back – a point the ATO is at pains to point out stating on its website that, “It doesn't mean that you will get an extra $1,080 in your tax return.”

The offset applies for a limited time. In this case, the offset applies to the 2018-19, 2019-20, 2020-21 and 2021-22 income years. So, if you are eligible to receive the offset, it applies to the taxable income you earned last financial year (2018-19) and you will receive any offset owing once you have lodged your tax return.

If you earned taxable income in 2018-19 of:

The LMITO is in addition to the existing low income tax offset (LITO). The LITO is available to those with taxable income of less than $66,667. The maximum offset is $445 for those with taxable incomes of $37,000 or less. Any amount you earn above $37,000 up to the threshold of $66,667 reduces the offset by 1.5%. Once again, the LITO is a tax offset to reduce the amount of tax you pay. If you do not pay personal income tax, you do not receive the offset as a cash refund.

Two things occur from 1 July 2022:

These changes assume that the Government does not pare back the income tax changes in a future Budget.

From 1 July 2024, the 32.5% marginal tax rate will reduce to 30% and the number of taxpayers it applies to will increase with the maximum threshold moving from $120,000 to $200,000. The tax rate change applies to resident taxpayers and working holiday makers. Once again, this assumes that this tax rate and threshold change is not amended in a future Federal Budget.